Aggregate Consulting involves providing professional advice valuation services related to the mineral reserve deposits used in extraction, processing, and marketing of aggregate materials.

- Due Diligence Transaction and Valuation Advisory

Our services encompass comprehensive support for buyers and sellers in transaction and valuation applications. Whether you are in the process of buying or selling, accurate evaluation and a thorough understanding of inherent opportunities and risks are paramount. Our team of market experts is prepared to collaborate with your leadership team, employing effective strategies to assess opportunities and offers most efficiently. Through the implementation of validated strategies and methods—from the initial contact phase through due diligence activities to the closing process—you can minimize disruption to day-to-day operations while gaining the comprehensive insight needed to thoroughly assess and substantiate the transaction or valuation.

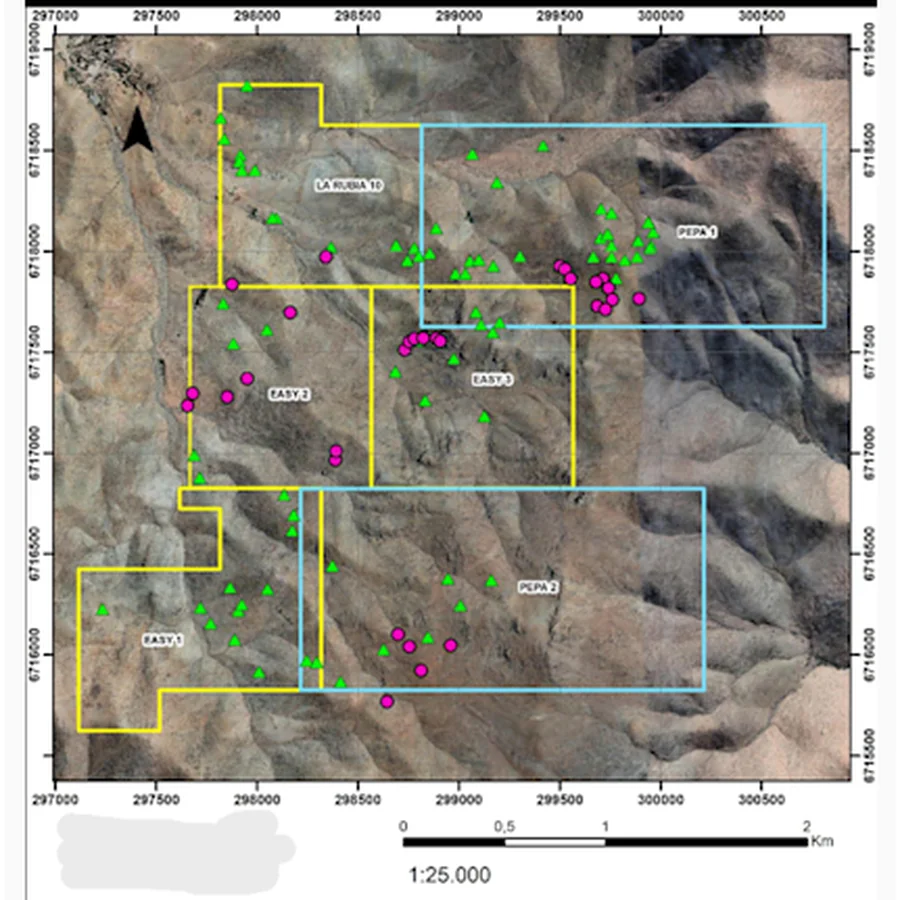

2. Resource Assessment: Evaluate the quantity and quality of the aggregate resources in the deposit. This involves geological surveys, core drilling, and sampling to determine the composition and volume of the material.

3. Market Analysis: Consider market demand for aggregates in the region and analyze current and future market trends. Understanding the market dynamics is essential for determining the potential sales and pricing of the extracted materials.

4. Financial Modeling: Develop financial models to estimate the potential revenue and costs associated with the aggregate extraction and processing. This includes factors such as production costs, transportation costs, and market prices.

5. Discounted Cash Flow (DCF) Analysis: Apply financial valuation methods, such as discounted cash flow analysis, to determine the present value of future cash flows generated by the aggregate reserves. This takes into account the time value of money.

6. Risk Assessment: Identify and evaluate potential risks and uncertainties that could affect the economic viability of the aggregate operation. This includes factors such as market volatility, regulatory changes, and unexpected production issues.

7. Report Generation: Prepare a comprehensive valuation report that outlines the findings, assumptions, and conclusions of the aggregate valuation process. This report is often used for internal decision-making, financial planning, and external communication with stakeholders.

Aggregate mine reserve valuation requires a multidisciplinary approach, involving expertise in geology, engineering, finance, and regulatory compliance. Aggregate Consulting specializes in aggregate valuation and can assist mining companies, lenders and investors, in making informed decisions about their operations, acquisitions, or divestitures.